#attorney for irs problems

Explore tagged Tumblr posts

Text

0 notes

Text

Federal prosecutors seek to silence Eithan Haim and his attorneys after they exposed major problems in the Biden Administration’s criminal targeting of the Dallas surgeon who blew the whistle on the mutilation of minors.

Last week, federal prosecutors filed a Motion to Gag both Dr. Haim and the lawyers defending him against criminal charges the Department of Justice filed against the Texas physician in May 2024. The Biden Administration indicted Dr. Haim on spurious grounds after he leaked evidence a year earlier to journalist Christopher Rufo that the Texas Children’s Hospital was removing the healthy breasts and genitals of children.

Currently, Dr. Haim faces five criminal counts of violating the Health Insurance Portability and Accountability Act, or HIPAA, brought by a Second Superseding Indictment. Federal prosecutors filed a Second Superseding Indictment after the first two indictments against Haim included glaring mistakes — ones Haim and his counsel pointed out in various X posts.

Those posts caught the ire of the Department of Justice, with the federal prosecutors arguing in their Motion to Gag that the posts on X “could interfere with a fair trial or otherwise prejudice the Government or the administration of justice because they discuss and characterize the substance of pretrial proceedings that would ordinarily be excluded from consi

16 notes

·

View notes

Text

Dirty Windows | 10 | Nora x Hancock

A Fallout 4 Soulmate AU

\\

Fic Summary:

Hancock never thought he would find his soulmate. Once a common occurrence, soulmates turned into a bit of a rarity after the bombs dropped. It was to be expected when there was an influx of people getting shot in the face on a daily basis. So when Hancock discovered that he had a soulmate he was ecstatic; all of the people in the Commonwealth, and he was one of the lucky few.

Too bad his soulmate didn't want anything to do with him.

When Nora thought for sure she was going to die too, the pain stopped – and then there was nothing. Nothing but the emptiness. Nothing but the grief. Half of her soul was suddenly gone forever. She was dropped in the middle of the ocean, drifting among the waves with no land in sight. Then just as suddenly she had been cast adrift, she found land. The hole was filled the moment it had been created. As she gripped Nate’s vault suit and begged him to open his eyes, Nora found herself battling with the horrifying realization that she had another soulmate; that some stranger had taken Nate's place.

\\

[ 1 ] <- [ 5 ] [ 6 ] [ 7 ] [ 8 ] [ 9 ] - [ 11 ]

\\

Nora Morrison was a woman who firmly believed in law and order; she believed in the justice system. She believed that those who infringed upon the law must be judged by a group of their peers, and given a just sentence. The problem was that there was no room for old world ideals in the Commonwealth. These people were murderers who showed absolutely no hesitation, and they had no fear of any potential consequences, because there were none. These people were wild, and they were crazy, and for some reason they really seemed to want Nora dead. During her stint as a prosecuting attorney, Nora had been on the receiving end of a whole lot of ire – but this was something else entirely.

The, admittedly petty, endeavor to hate her soulmate and drive him away crumbled the very moment he came barging back into her head. It should be strange, how he was consistently there whenever she needed him. Like he would always come and check on her at just the right time. It was typically deeply annoying, and she often wished him away. This time she not only welcomed the man, but she finally reached out to him willfully. Their connection became firmly set, so steadfast that it felt like a tangible thing. The man gasped softly.

Nora’s vision was clouded with the man’s view of whatever room he was in – there was a chair sitting in front of an open window, a couch tucked off to the side of a room – before she pushed the image from her mind and focused on his emotions. There was a feeling of absolute panic, but there was an underlying layer of anger. He would have to work on controlling his own emotions when accessing their bond; he was letting her feelings influence his to a noticeable degree.

She took a slow breath, catching the smell of phantom cigarette smoke, something like burning petrichor, and something else that was tangy-sweet. That was from him. Those were his senses.

Another breath and she was picking up the smell of dust, coppery blood, and rotting wood. Mold. Mildew. That was her environment.

It took her a handful of precious seconds to make the connection to his mind, and then sift through all of the accompanying sensations until she was left with what she wanted. It was his emotions that she needed, and even though she was seeking out some sort of level-headed calm, she could work with his anger – she could feed off of it.

Nora struggled under the dead weight of the man she killed as she tried to prop his corpse up against the old desk she hid behind. Even the slightest bit of anger helped take the shake out of her hands, and brought some strength back to her limbs. She’d definitely need to be nice to her soulmate after this.

“Do you have time to reload?” His graveled voice was rasping low and threatening. “Find some more mags t’pack around after this. Running into a goddamn firefight with just one was real damn stupid.”

Nora scoffed. She slid the magazine free and started shoving in bullet after bullet until the magazine was full. “It’s not like I did it on purpose,” she growled, her tone matching his. More gunfire punctuated the statement, more yelling followed.

“How many you got left?” Her eyes dipped down to her gun. “Not bullets. I saw how many bullets you got. How many assholes are there tryin’ t’kill ya?”

Nora chanced a quick peak, yelping as the edge of her cover was torn away by a bullet. It wasn’t really much cover, it was an old heavy wooden desk but it was doing a mighty fine job at keeping her safe at the moment. “Three?”

“Was that a question or an answer?”

Biting down on her tongue was the only way to prevent herself from swearing at him. Ultimately, she didn’t mind swearing – Nate had a military mouth – but she herself tried to avoid cursing. It wasn’t lady-like, for one thing. A visceral memory of her mother forcing her to bite down on a bar of soap for having a “dirty mouth” was another.

“I counted three,” she ground out.

“Yer gonna hafta kill ‘em,” he replied. “And yer not gonna have the time to be gettin’ sick every time you do it, ya feel me?”

The connection she established faltered when her eyes drifted to the corpse she sat beside. She had killed a man. It wasn’t her first time seeing a dead body; she hadn’t shied away from crime scenes and morgue visits in her career. It was so much more different, though, knowing that she was the one that made the kill. She took someone’s life. Despite the situation, a surge of guilt had her eyes growing misty.

“Hey, sister, get yer head in the game!” Her eyes snapped to the side, away from the body, the connection stabilizing.

The man was irritated, she could feel it right along with his anger. She could use that, too. The only problem with utilizing those emotions was that she found herself snapping right back at him, “I told you to stop yelling at me!”

“Then focus!”

“You focus!”

It had been bound to happen. The stranger was overly receptive to her emotions, incapable of blocking them from affecting his own. During his last visit, he had come barging into her headspace only for his intentions to be broken down under the assault of her own grief. In Nora’s current circumstance, with both of them reaching for the other, and with the man incapable – or unwilling – to block out her emotions, they were creating a feedback loop of sorts. His anger affected her, affected him, affected her…

Even though Nora was aware of it happening, having a building white-hot rage burning in her chest was leagues better than the raw guilt that was roiling in her gut. She leaned into it, embraced it as tightly as she could.

The stranger growled. It was a deep, rumbling sound that carried more gravel than a quarry. It sounded like a feral animal. “Shoot at them. Stay below cover.”

She did. Remaining tucked low behind cover, she fired in her assailant’s direction blindly. There was a surprised yelp from their end of the fight this time, and then resounding laughter. She fired again, and the laughing fell silent.

“Okay. You’re going to push our friend away from you. Out from cover. Use him to draw fire.” His words were clipped, and precise, and they left very little room for argument. Nora took hold of the corpse’s shoulder just before her soulmate continued. “Hey.”

She paused.

“You’re going to get one shot at this. Make it fuckin’ count, you hear me?”

“I hear you.”

Nora gave the corpse a firm push, and his body toppled out from behind the overturned desk she crouched behind. The movement caught her assailants’ attention, and the corpse promptly became riddled with bullets. From the other side of the desk, Nora peered out from cover. She caught her first target crouching out in the open, a look of shock on his face. He started to redirect his aim just as she settled hers on him.

“Shoot him.”

Nora pulled the trigger. The gun jumped in her hand, and she ended up shooting too wide.

“Lean into the shot! Pull the trigger and fuckin’ MEAN IT! This is your life or theirs! Kill them!”

She did.

She killed all three.

Tags: @takottai

As a note, dear tag lister: I have 41 (almost 42) chapters of this thing ready to go. Holler if you ever want off the ride.

#Fallout 4#Hancock x Nora#Nora x Hancock#Hancock / Nora#Hancock x Sole Survivor#Hancock / Sole Survivor#Fallout Fanfiction#Fallout Soulmate AU#Soulmate AU#Romance#Angst#One Sided Pining to Mutual Pining#Canon Typical Violence#Drug Use#Alcohol Use#Human x Ghoul#Fallout Hancock#female sole survivor x hancock#Nora Calls Hancock John#Dirty Windows#Slowish Burn#Author is renovating all of the buildings in the commonwealth#No Beta - I'm dying over here#enemies to lovers

38 notes

·

View notes

Note

kc + caroline has MANY complaints about klaus but her biggest one is that the only time he responds to her follow up emails is to ask whether something is illegal

Per My Last Email || Klaroline

Weirdly canon-esque, and I have no defense. But we all know Klaus would be Caroline's neediest client.

.

Dear Mr. Mikaelson:

Per the agreement you signed, my services have been retained for legal representation on your accumulated traffic tickets ONLY. Please note that these emails fall under attorney-client privilege, but you should still avoid excessive details that would test my standing as an officer of the court. I trust that you will respect my professional boundaries, as difficult as that will be for you. To make sure I have all the relevant information at hand, please forward me the details of your current ID, vehicle descriptions, and all license numbers.

As your court date is tomorrow, please respond as soon as possible. Otherwise, I would highly recommend paying your tickets before 9 a.m. via the online portal. My retainer fee, however, is nonrefundable.

ID, vehicle descriptions, and license numbers, ASAP.

Best,

Caroline Forbes Salvatore

Attorney, MF Group

.

Sweetheart, settle a bet for me. Kol insists his baseball bat is considered a deadly weapon, but surely it's just the force with which he can wield the bat that makes it deadly - therefore, its presence alone cannot be considered "assault with a deadly weapon."

A speedy answer would be appreciated, I just noticed the local bar installed a security camera that may limit your legal arguments after the fact.

x

.

And don't think I didn't notice the "Salvatore" in your signature.

I did.

x

.

Dear Mr. Mikaelson,

My married name is registered with the state bar association and a matter of public record. In fact, my ability to practice in Louisiana is predicated on the fact that "Caroline Forbes Salvatore" holds a valid law degree and active license. If you have a problem with that, please feel free to retain other representation.

That said, I do want to remind you that I may advise on hypothetical legal scenarios, but will not abet any illegal activity such as assault with a deadly weapon. The threatening manner in which you imply your brother might wield a baseball bat, hypothetically, would be enough to enhance any assault charges possibly caught on camera.

As your lawyer, I don't recommend putting these hypotheticals in writing, and I really don't recommend letting Kol loose on New Orleans with a bat. Hypothetically, the whole city has cameras and it's a miracle certain activities haven't come to light. Yet.

Since you failed to send me the necessary details before your court date, I asked Elijah. You're welcome for getting the parking tickets dismissed, by the way, even though your behavior in court was detrimental to your case. The judge was not amused by your sense of humor, and neither was I. To prevent a repeat performance, I would suggest storing your luxury sports car in your massive compound instead of literally the middle of a pedestrian plaza. Just a thought.

Elijah has also taken care of your court fees and my incidentals since I had to void your last payment. Next time, please just pay the invoice. You don't tip your lawyer.

Best,

Caroline Forbes Salvatore

Attorney, MF Group

.

Love - quick question. Rebekah is throwing a bit of a tantrum and stole the doppelgänger blood I had stored. Is this a civil suit situation, or can I press criminal charges? Honestly, I think she'd have a lark in prison, but I think the inconvenience would be consequence enough for her to feel my ire.

x

.

Mr. Mikaelson,

Again, I'm sure this is a hypothetical situation where your sister, who lives in your shared family domicile and therefore has rights to whatever is stored inside, takes something of no actual value, such as human blood stored for medical study and nothing else, then - hypothetically - a grown man with substantial resources like yourself can surely see that neither a civil suit nor criminal charges would be wise to file. None of those details of a...supernatural...sort would belong in the public record.

Not to mention, sending your sister to prison would only get me and several other people killed.

Hypothetically.

Seriously, I'm too busy for this, and I'm not even on retainer anymore. I will be sending Elijah an invoice for this email communication.

Best,

Caroline Forbes Salvatore

Attorney, MF Group

.

I've wired a retainer fee directly to your account. And since you're on the payroll, I have some paperwork to go through. Working dinner? I'll buy.

x

.

Caroline: Klaus, you cannot send me a million dollars in a personal check.

Klaus: Clearly, I can. Dinner?

Caroline: ...

Caroline: ...

Klaus: I'm thinking Italian.

Caroline: If you think this counts as a retainer fee, I do not have the time to explain how wrong you are, but I will if I have to. To be clear, that is a threat, and you know I will follow through, complete with slide deck and appendices. If you would indeed like to retain my services for the family, Elijah and I have already worked through an initial contract with LIMITS, you absolute ass. All official business will go through him, I swear, or you will regret it.

Caroline: Again, that is a threat.

Klaus: So, see you at eight?

Caroline: ...

Caroline: I'm donating the money you sent.

Caroline: But yeah, Italian sounds good.

Klaus: Change your email signature.

Caroline: Don't push it.

51 notes

·

View notes

Text

waslooking through the tourette's tag on ao3 earlier and am both happy and kind of sad to say the top fandom is creepypasta. Happy because thats my boy toby 🔥🔥🔥🔥 but sad because like damn okay there really Arent other characters with. tourettes. in like anything. some of the next top fandoms are dsmp rpf, bnha & the mcu and like correct me if i am wrong but having been in two of those three fandoms for a while (admittedly several years ago) i think those are just headcanons. and dont get me wrong i love headcanons so so so much (theres this one fic with someones headcanon about trucy ace attorney having tourettes and i love it to bits) but like wtf. why cant they start putting tourettes syndrome havers (touretters? tourettesers? tourettics? idfk) in evwrything. like i Know why its because "oh noooooo hes twitching and making NOISES hes a FREAK!!!!!!!! and/or a psycho killer!!!!!! aaaaaaaaahhhhh!!!" but also thats Their problem not mine. anyway i cant change the canonical tourettes-having status of popular fictional characters but i CAN and WILL hype tourettes headcanons up.!! if you have a headcanon for any character about tourettes and you like writing go write about it!!!!!!!! ESPECIALLY IF YOU HAVE TICS YOURSWLF!!!!!! I LOVE READING FICS WHERE PEOPLE HEADCANON THEIR FAVES AS HAVING THE SAME THINGS THEY DO!!!!!!!!!!!does not matter if you think your writing sucks xause first of all u gotta suck to get better at aomething. but also it literally couldnt suck because you gave your blorbo tourettes and rhats sick as hell thank you for uour service. i think i maybe had a point here but i forgot ir my bad. ummm yeah. shia labeouf had a point* bro dont let uour dreams be dreams. yesterday you said youd write that fic tomorrow so just DO IT!!!

*he did not havw a point when i was walking through the woods there was no one around and my phone was dead but out of the corner of my eye i spotted him. Anywho i digress

anyways.

my final messagw: read the aforementioned trucy wright ace attorney tourette's fic... (it holds a place in my heart dude........ Shes just like me for real!!!!!)

Goodby e

#muffin mumbles#im not leaving or anything you fellas cant get ridda me that easy. im just always thinking abt my final message: change da world... goodbye#tourettes#im not doing more tags im tired and that gets yhe point across

9 notes

·

View notes

Text

Excu-u-u-se me! The hush money was paid BEFORE Trump was elected President.

Nothing to do with ‘Presidential Immunity’

He could have pardoned himself WHILE President for the federal offenses in the payments but n-o-o-o-o! Because that would have made it easier for the IRS and FEC to fine him for the payment since accepting a pardon is an admission of guilt.

Of course Presidential pardons don’t apply to State crimes but the wannabe I-can-kill-my-political-enemies-dictator figures that’s no problem if he’s re-elected.

Could also have pardoned Flynn, Bannon, Stone (all for a second time) , as well as co-conspirators in the Aministration & Congress, any fake electors, and all the violent J6-ers wallowing in prison or awaiting trial.

But he didn’t.

Because human piles-of-💩 enjoy the misery of others. Particularly if they are the cause of it.

Of course, at some level in his mind seeing all his followers wearing the same cult clothing prompted a recollection of the Heaven’s Gate cult all also getting identical tennis shoes.

Before obeying the Cult Leader and ‘rapturing’ off the earth in a mass suicide in 1996.

19 notes

·

View notes

Text

Rachel Leingang at The Guardian:

In his first campaign rally after being convicted of 34 felonies, former president Donald Trump recalled how he just went through a “rigged” trial with a “highly conflicted” judge despite there being “no crime”. The court cases Trump faces have become a mainstay of his campaigning throughout the last year, where he frequently tells his followers that the charges are a form of election interference and designed to tamp down the Maga movement. “Those appellate courts have to step up and straighten things out, or we’re not going to have a country any longer,” he said.

Trump spoke at a Turning Point Action event in sweltering Phoenix, at Dream City church, a megachurch where he and Turning Point have held rallies in the past. The extreme heat led to some waiting outside for the venue to open to need medical attention for heatstroke. Trump held a rally at the same church in 2020, during the height of the pandemic, when church leaders claimed to have an air-purification system that killed 99% of the Covid-19 virus. Turning Point Action is the campaign arm of Turning Point, the conservative youth group founded by Charlie Kirk, a figure in the Maga movement. The former president also took aim at Joe Biden’s recent executive order limiting asylum seekers, which Trump called “bullshit” and said he would rescind on his first day in office, should he win. He condemned Biden on immigration and ran down Trump administration border policies, saying his Democratic rival could solve immigration problems by reinstating all of his old policies. “Arizona is being turned into a dumping ground for the dungeons of the third world,” Trump said.

While immigration is a top issue for voters nationwide, it is especially acute in a border state like Arizona, which Trump hit on in his speech. He wistfully recalled the days of former Maricopa county sheriff Joe Arpaio, infamous for his strict immigration policies that led to frequent lawsuits and financial settlements, and brought Arpaio on stage for impromptu remarks. Trump kissed Arpaio on the cheek, then said: “I don’t kiss men, but I kissed him. We had a real border with this guy.” Arpaio called Trump his hero.

[...] For the Trump faithful, the convictions have become a point of ire against the other side and something akin to pride. Shirts and signs at the Phoenix rally said “I’m voting for the convicted felon”. Trump repeated claims of a stolen election, saying the Democrats “used Covid to cheat” in 2020. He welcomed Kari Lake, the losing gubernatorial candidate in 2022 who is now running for Senate, and Abe Hamadeh, the losing attorney general candidate now running for Congress, claiming that they won their races but their elections were rigged.

In his first post-felony conviction rally, Convicted Felon Donald Trump went on his whinefest about the verdict that served him 34 felony convictions, attacked President Joe Biden’s MAGA-lite executive order on asylum, and continued his lies about the “stolen” election of 2020.

See Also:

Daily Kos: Convicted felon Donald Trump gives big kiss to disgraced former sheriff Joe Arpaio, who he pardoned

#Trump Rallies#Donald Trump#Turning Point Action#Joe Arpaio#Immigration#Charlie Kirk#Dream City Church#People of New York v. Trump

6 notes

·

View notes

Note

So in the ask Tumblr ate I said

So I too have problems with the Apollo trilogy. So I will list them. But I don't wanna be too negative so I will list positives of the other games.

Apollo Justice sees Phoenix get character assassinated and how come NO ONE DECIDED TO HELP HIM GET HIS BADGE BACK!? Also the magic panties jokes just make me uncomfortable, especially since Trucy is a minor

Dual Destinies had one case that is discount Big Top (I hate game Big Top as much as the next guy, but I was introduced to Ace Attorney via the Anime where it was amazing) and Turnabout Academy, where we find out that parents of a student have been bribing the teachers to give the student good grades without the student knowing. Um...THAT ALREADY HAPPENED!? WHY IS THAT NOT ACKNOWLEDGED!?

Spirit of Justice has amazing concepts executed poorly. That's also why it's my favorite of the Apollo Trilogy. I love media with missed potential. I like rewriting

Now for postives

The first Ace Attorney everything felt grounded and nessasary. No case felt like filler.

JFA has Farewell my Turnabout. Excellent case and I love fictional kidnapping plots. It was so emotional

TandT. Mia's first case, adorable Phoenix, the first non-murder case (though it turns to murder), my favorite defendant (Ronnie!), Iris x Phoenix, more Fey clan drama, Godot, Miego, AN EXCORISM IN THE COURT!???? I LOVE THAT GAME!!!!

Investigations! Flashback case! Mini ziska protecting Miles from her father by diverting his ire. Miles getting attacked by Kay. Franziska wanting a Swiss roll but not admitting it! SIBLING INTERACTIONS!

Investigations 2! The only appearance of my favorite Ace Attorney character, Yumihiko Ichiyanagi, known as Sebastian Debeste in the fan translation. Great character development for most characters, long cases, playable Gregory Edgeworth! Also I like to believe after the events of the game Hakari Mikagami remains Yumihiko's mother figure and Edgey becomes his father figure. But this game you constantly felt in danger, and you faced dangerous people. And there was a kidnapping plot! Logic chess is amazing and KAY AND EDGEWORTH ARE PRECIOUS! If not father and daughter than brother and sister

Bonus!

In Project X Zone 2, Phoenix just wants to go home. He can't because a Bounty Hunter will kill him. He is one of like, three sane characters, the other being Reiji Arisu (original to the X series) and Chrom (Fire Emblem)

Maya is HERE for the action! She says M. Bison has a butt chin TO HIS FACE! She is having waaaay to much fun!

Apparently during the trial, Phoenix had to tell Majima not to punch the judge

Lastly, I leave you with this offical art by Fire Emblem: Awakening's lead artist

2/2 Oh I forgot to add. I played the fan translation of The Great Ace Attorney and loved it. Best depiction of Sherlock Holmes

Responding under the cut so this doesn't get insanely long!!

My issues with AJ tend to be more from the standpoint that I find the cases to be slightly poorly constructed and uninteresting personally and less that I dislike the characters/characterisation of preexisting characters. I get where the character assassination viewpoint comes from, but I don't really agree/mind it very much. Phoenix has shown many instances where he will close himself off from his friends and simply refuse to talk because it hurts him too much to do so (not telling Maya what's up in JfA springs to mind immediately, but there's also the whole Dahlia/Iris debacle that happened which he just never brings up), so I think AJ Phoenix is just that pushed to the extreme. He's also got that tendency to mimic people he's around a lot, and we know he was hanging out with Kristoph very often during that time, so I think he picked up much of his slippery, oblique nature from him as well. Plus, he's been shown to go through extreme personality shifts; it's not that strange to me to think he'd have one when his life was falling apart around him. I'll be the first to admit that I'm not huge into AJ Phoenix, but while I may not like him very much, I do understand where it comes from. He wasn't even meant to be in the game at first so like. Eh. I'm mostly just glad he's still around.

As for the no one helping him get his badge back thing, I think they were trying to help. But the whole Dark Age of the Law thing doesn't happen in isolation; a failing legal system affects an entire society, so while I think his friends were trying to assist him as best they could, and as much as they would let him (because Phoenix isn't the type to readily accept help either. It has to do with that whole being closed off thing he does, and you can't really help someone who won't let you/doesn't want to be helped. At the end of the day, Phoenix is an adult and allowed to live his life as best as he sees fit), they probably had their own issues to figure out. As the future Chief Prosecutor, Edgeworth definitely would have been caught up in the entire mess that was the Dark Age and likely would have had too many more pressing cases to handle to really dedicate his time to Phoenix's plight. Phoenix probably decided it'd be faster and better for everyone if he took care of it in his own way. It's heavily implied that Edgeworth did help with the whole Mason system that comes in at the end of AJ, so I think they were probably working on it together in the background of the games anyway. I don't have much to say about the magic panties gag, that shit is weird, you're right HAHAH I don't think anyone who's played the game has found it funny so like ??? Don't know why it's there, don't like it, next.

I actually don't mind Big Top tbh; I think it has many interesting themes about secrecy, grief and responsibility. It's just a little long and has some WEIRD decisions made character-wise. The only thing I remember about DD's version is Trucy weeping, and Phoenix failing to fly back to be with her though she's been arrested (this is the bigger character assassination imo. Wtf, Phoenix. Even if you'd be late for the trial, you could still fly home). Shockingly enough, I liked Academy (in comparison to the rest of DD anyway). It's the single case which I actually found a semblance of enjoyment from in DD; it was funny and largely inoffensive, if not much else. Yeah, I'm pretty sure they were fine reusing Sebastian's backstory because it didn't play /that/ huge of a role in AAI2 and because AAI2 was never officially localised and therefore would be less popular/well known. I'm not particularly surprised; they've done worse than reuse a plotline.

SoJ is a complete mess in my opinion, but I'm glad you liked it <3

Mmhm, yeah, full agree on the original trilogy. It's great. Same with Investigations 1; I adored every single character introduced in that game. I thought it was super fun. I largely dislike the adjustment made in Kay and Edgeworth's relationship in AAI2, but I've spoken about that at length, so I won't go into it here. I found AAI2 slightly draggy and chaotic at times, but I get why people love it, and I really liked Sebastian and Justine. It was a lot more high stakes than usual, and I love that we got to see more of the prison system and the like, that was cool. It's a good one. I like it.

... Phoenix is being hunted by a bounty hunter?? Poor man can't catch a break. CHROM??? FEA CHROM????? Omg, it's him. Omg. I love you, Chrom. AND LUCINA!!!!! LUCINA, MY DAUGHTER!!!!!! That's soooo cute haha. This game seems like loads of fun. I like it so much.

3 notes

·

View notes

Text

“Give us back our horny”

Submitted by @officialfist

I expected legal challenges, you want them actually because they can be used to shore up the defenses as they say. Close the gaps that may have been left on accident. _______________________

BATON ROUGE, La. (WAFB) - The Free Speech Coalition is just one of many taking aim at a Louisiana law that went into effect last year.

It requires age verification for certain websites that consists of at least 30% adult content, like porn. The law’s intent is to keep minors off these sights, as the material continues to intensify on an annual basis.

“We’re not opposed at all to efforts to limit minors from accessing adult material, it’s called adult material for a reason. But the problem we have with these laws are they’re not only unconstitutional but they’re ineffective and dangerous,” said Director of Public Affairs for the group, Mike Stabile.

Stabile says the law’s vagueness makes it difficult for websites to abide by the standard to which the law holds them. Adding the 30% threshold these sites are held to is not specific enough on the type of content it’s referring to.

“We don’t know how that’s calculated. Is it the number of posts, the number of pages, the volume of data...I think what you see in this law and the other copycat laws you see in other states is that they’re the product of magical thinking,” Stabile added.

Stabile says instead of trying to legislate how sites should verify age and requiring citizens to subject themselves to potentially having their personal information and web browsing history exposed, the state should take the approach of a device-level filter.

“Fewer than 20% of parents include any type of filter on their kids’ devices. And what the supreme court has said in case after case is that so long as those filters exist, as long as a less restrictive method that doesn’t endanger people’s privacy that doesn’t limit their access to first amendment protected speech exists, these government filters and mandates are unconstitutional,” Stabile explained.

The lawmaker behind this, state Rep. Laurie Schlegel defended her bill in messages to us Tuesday by saying the law was thoroughly crafted and does not infringe on anyone’s rights. She also managed to pass another law this year allowing the Attorney General to fine adult sites up to $5000 for every day they fail to comply with state law.

“This is a law that is going to cost Louisiana taxpayers half a million dollars or more to defend. And at the end of the day, the Supreme Court has ruled on this many times. The government does not have a right to unreasonably limit access to otherwise legally protected first amendment speech,” Stabile continued.

The Attorney General’s office says their office is reviewing the filing and withheld any further comment. ______________________

30% eh, reddit and twitter might be in trouble here too then.

Adult content, that is kinda vague. I'd argue the IRS website is adult content, but well see how this goes for them.

5 notes

·

View notes

Text

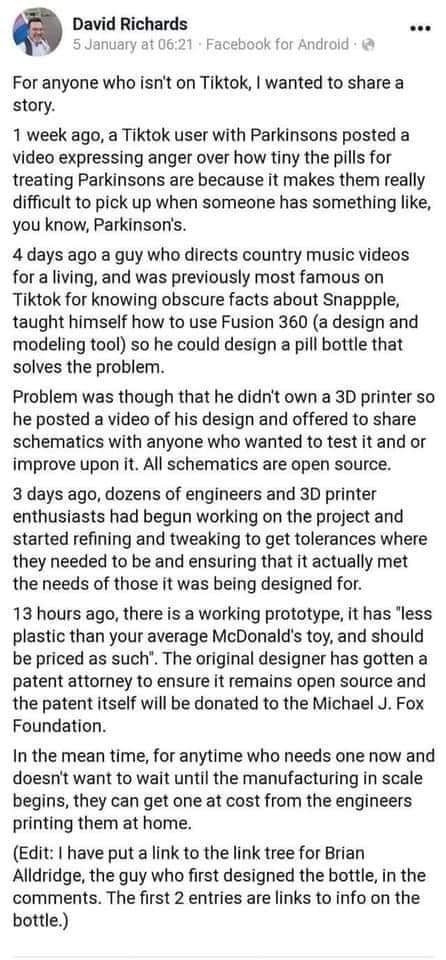

[Image ID: Facebook post from David Richards reading: For anyone who isn't on Tiktok, I wanted to share a story.

1 week ago, a Tiktok user with Parkinsons posted a video expressing anger over how tiny the pills for treating Parkinsons are because it makes them really difficult to pick up when someone has something like, you know, Parkinson's.

4 days ago a guy who directs country music videos for a living, and was previously most famous on Tiktok for knowing obscure facts about Snappple, taught himself how to use Fusion 360 (a design modeling tool) so he could design a pill bottle that solves the problem.

Problem was though he didn't own a 3D printer so he posted a video of his design and offered to share schematics with anyone who wanted to test it and or improve upon it. All schematics are open source.

3 days ago, dozens of engineers and 3D printer enthusiasts had begun working on the project and started refining and tweaking to get tolerances where they needed to be and ensuring that it actually met the needs of those it was being designed for.

13 hours ago, there is a working prototype, it has "less plastic than your average McDonald's toy, and should be priced as such". The original designer has gotten a patent attorney to ensure ir repains open source and the patent itself will be donated to the Michael J. Fox Foundation.

In the mean time, for anyone who needs one now and doesn't want to wait until the manufacturing in scale begins, they can get one at cost from the engineers printing them at home.

(Edit: I have put a link to the link tree for Brian Alldridge, the guy who first designed the bottle, in the comments. The first 2 entries are links to info on the bottle.) /End ID]

188K notes

·

View notes

Text

Explore how a tax attorney negotiates with the IRS to resolve tax debt efficiently. Protect rights, reduce stress, and find solutions with legal expertise. Consult an IRS tax settlement attorney for personalized and effective resolution strategies.

0 notes

Text

Tax Consultation Near Me

Finding the Right Tax Consultation Near Me: Why You Need One and How It Can Help

Taxes are an inevitable part of life, and for many individuals and businesses, tax season can be an overwhelming and stressful time. With complex tax laws, ever-changing regulations, and the potential for costly mistakes, it’s essential to have professional guidance to navigate the world of taxes. This is where tax consultation services come in. Whether you’re looking for advice on filing taxes, minimizing liabilities, or dealing with tax issues, a tax consultation near you can provide the support you need to ensure that your taxes are handled properly.

In this article, we will explore why you should seek a tax consultation near you, how these services can benefit you, and how finding the right tax consultant can help you achieve peace of mind when dealing with taxes.

What is Tax Consultation?

Tax consultation refers to professional services provided by tax experts who offer guidance and advice on various tax-related matters. This consultation can cover a wide range of topics, including tax planning, tax preparation, strategies to reduce tax liabilities, and resolving tax issues. Tax consultants are typically certified professionals, such as Certified Public Accountants (CPAs) or tax attorneys, who have specialized knowledge of tax law and regulations.

Tax consultation near you provides an opportunity to work directly with a tax expert who understands local, state, and federal tax laws, as well as any specific regulations relevant to your situation. By engaging in tax consultation, you can receive personalized advice tailored to your unique needs and circumstances.

Why You Need a Tax Consultation Near Me

There are numerous reasons why individuals and businesses seek tax consultation. Whether you're facing tax season or dealing with specific tax challenges, a tax consultant can provide valuable expertise. Here are some common scenarios where you might benefit from a tax consultation:

1. Tax Filing and Preparation

One of the most common reasons people seek tax consultation is to ensure that their tax returns are filed correctly and on time. Filing taxes can be complicated, especially for individuals with multiple sources of income, business owners, or those who have investments, real estate, or other financial complexities.

A tax consultation near you can help ensure that all forms are properly filled out, all deductions are accounted for, and you’re in compliance with tax laws. Tax consultants can also provide advice on the best filing strategies to minimize your tax liabilities and ensure you’re getting the most out of available credits and deductions.

2. Tax Planning and Strategy

Tax planning is an essential part of managing your finances, especially for those who are self-employed, own businesses, or have multiple income streams. Effective tax planning can help you reduce your taxable income and minimize your overall tax burden.

A tax consultation can help you develop a strategy to manage your income, expenses, deductions, and tax credits to minimize liabilities. Whether you need advice on retirement planning, real estate investments, or business deductions, a tax consultant can help you plan ahead and make informed decisions about your financial future. Proper planning can also prevent future tax-related issues and ensure long-term financial stability.

3. Resolving Tax Issues

If you’re facing tax issues such as overdue taxes, audits, penalties, or disputes with the IRS, a tax consultation can help you navigate these challenges. An experienced tax consultant can assess your situation, identify potential issues, and provide recommendations for resolving tax-related problems.

Tax consultants can assist with negotiating payment plans, seeking reductions in penalties, and representing you in tax disputes. They can also help you prepare for IRS audits, ensuring that you understand your rights and responsibilities and are fully prepared to respond to any inquiries. A tax consultation can provide peace of mind and the expertise needed to handle difficult tax situations.

4. Business Tax Matters

For business owners, tax consultation is an essential service. Running a business involves complex financial transactions, and taxes are one of the most significant challenges faced by entrepreneurs. A tax consultant can help with everything from understanding business deductions to navigating sales tax requirements and handling payroll taxes.

Whether you're just starting a business or have an established company, a tax consultation can ensure that you're taking advantage of all possible tax benefits and complying with applicable business tax regulations. A tax consultant can also advise on tax-efficient business structures, such as whether to operate as an LLC, S-Corp, or other entity types, which can significantly impact your tax liabilities.

5. Tax Implications of Life Changes

Life events such as marriage, divorce, the birth of a child, or a change in employment status can have significant tax implications. In these cases, seeking a tax consultation near you is essential to understanding how these changes will affect your taxes.

A tax consultant can advise you on how to adjust your withholding, maximize available tax credits or deductions (such as child tax credits), and ensure that you're prepared for any changes in your tax filing status. Whether you’ve experienced a major life event or just want to plan ahead for the future, a tax consultation can provide the clarity and direction needed to make smart tax decisions.

How a Tax Consultation Near Me Can Help

Having a tax consultation near you offers several advantages, including personalized, local expertise, and the ability to build a long-term relationship with a trusted advisor. Here are a few key ways that a tax consultation can be beneficial:

1. Local Expertise and Knowledge of Regional Tax Laws

Tax laws vary by state and locality, and understanding local regulations can be critical to ensuring that you comply with tax requirements and minimize your liabilities. A tax consultant located near you is familiar with the tax rules specific to your state or municipality and can provide advice tailored to your location.

Whether you’re dealing with state income tax, local sales tax, or other regional tax issues, a local tax consultant can ensure that you’re in full compliance with the rules and regulations that apply to you. They can also help you navigate any incentives, deductions, or credits that are unique to your area.

2. Personalized Advice Based on Your Situation

One of the greatest benefits of a tax consultation is the ability to receive personalized, one-on-one advice. Unlike online tax services or general tax guides, a tax consultant takes the time to understand your unique financial situation and provides tailored recommendations based on your needs.

Whether you’re an individual taxpayer with a straightforward filing or a business owner with more complex tax needs, a tax consultant can provide advice specific to your situation. This personalized attention ensures that you're making the right decisions for your financial future.

3. Avoiding Costly Mistakes

Filing taxes incorrectly, missing important deductions, or failing to pay the correct amount of tax can result in penalties, interest, and even legal trouble. A tax consultation helps you avoid costly mistakes by ensuring that your filings are accurate, your deductions are maximized, and your tax liabilities are minimized.

With the expertise of a tax consultant, you can reduce the risk of audits or tax-related issues that could lead to costly consequences. By getting professional advice up front, you’ll be better positioned to make informed decisions and avoid the need for costly corrective action later on.

4. Peace of Mind

Taxes can be a source of stress, especially when you’re unsure if you’re handling them correctly. By seeking a tax consultation near you, you can have peace of mind knowing that an expert is helping you navigate the complexities of tax law. Whether you’re filing your personal taxes or handling the finances of a business, having a professional guide you through the process ensures that you’re taking the right steps to stay compliant and avoid tax-related problems.

5. Ongoing Support

Many tax consultants offer ongoing support for individuals and businesses, helping you plan for future tax seasons and avoid surprises down the road. Establishing a relationship with a local tax consultant can provide long-term benefits, as they will become familiar with your financial situation and offer proactive advice as your circumstances change.

From preparing tax returns annually to providing guidance on financial decisions throughout the year, ongoing support from a tax consultant can keep you on track and ensure that you’re always making the best choices for your tax situation.

Conclusion

Tax consultation near you is an invaluable resource for individuals and businesses looking to navigate the complexities of the tax world. Whether you need help filing taxes, planning for the future, or resolving tax issues, a tax consultant can provide the expertise and guidance you need to make informed decisions and avoid costly mistakes.

With the personalized advice, local expertise, and long-term support offered by tax consultation services, you can approach tax season with confidence, knowing that your taxes are in good hands. Don’t wait until tax issues arise—seek a tax consultation near you today and take the first step toward securing your financial future.

1 note

·

View note

Text

Tax Advocate Tips: Making the Most of Your Tax Situation

Navigating the complex world of taxes can be overwhelming for many individuals and businesses. The fear of making errors or missing out on opportunities for savings is a common concern. This is where a tax advocate can be a valuable ally. By leveraging the expertise of a tax advocate, you can ensure that you're making the most of your tax situation. Whether you're dealing with IRS issues or looking for strategies to optimize your tax filings, a tax advocate can guide you through the process. In this blog post, we'll explore various aspects of working with a tax advocate, including understanding their role, identifying common tax issues they can help with, and choosing the right advocate for your needs.

Understanding the Role of a Tax Advocate

A tax advocate is a professional skilled in navigating tax laws and IRS procedures. Acting as intermediaries, they provide advice, support, and representation to taxpayers. Their expertise includes resolving tax-related issues such as correcting errors, negotiating settlements, and appealing IRS decisions. Tax advocates ensure that taxpayers' rights are upheld and offer tailored strategies to manage and optimize tax situations. Their deep understanding of tax regulations allows them to effectively communicate with the IRS and work towards favorable outcomes for their clients.

Common Tax Issues a Tax Advocate Can Help Resolve

Tax advocates assist with various tax issues, including disputing inaccurate tax assessments or penalties. They can review IRS notices for errors and communicate with the IRS to resolve discrepancies. If you're struggling with tax debt, a tax advocate can negotiate payment plans or settlements, such as an Offer in Compromise. Additionally, they help with unfiled tax returns, audits, and tax problems related to identity theft. Their expertise ensures that your tax matters are addressed efficiently and fairly, reducing stress and potential financial liabilities.

How to Choose the Right Tax Advocate for Your Needs

Choosing the right tax advocate involves careful consideration of several factors. Begin by seeking referrals from trusted sources such as friends, family, or financial advisors. Research potential candidates by checking their credentials, experience, and professional reputation. Verify that the tax advocate is a licensed professional, like an enrolled agent, CPA, or tax attorney. During initial consultations, ask about their experience with similar cases and their approach to resolving tax issues. Ensure you're comfortable with their communication style and transparency. Lastly, evaluate their fees to see if they align with your budget and expectations.

Steps to Take Before Meeting with a Tax Advocate

Before meeting with a tax advocate, it's crucial to be well-prepared to make the most of your consultation. Start by gathering all relevant documents, including tax returns, IRS notices, financial statements, and any correspondence with the IRS. Organize these documents chronologically for easy reference. Make a list of specific questions or concerns about your tax situation and outline any goals you hope to achieve with the advocate's help. This preparation will enable the tax advocate to assess your case accurately and provide tailored advice. Additionally, clarify your budget and be ready to discuss the advocate's fees and payment terms during the meeting.

What to Expect During Your First Consultation with a Tax Advocate

During your first consultation with a tax advocate, you'll delve into the specifics of your tax issues. The advocate will thoroughly review your documentation, which should include tax returns, IRS notices, financial statements, and any correspondence with the IRS. They will ask detailed questions to get a full picture of your situation and identify any immediate areas of concern.

The advocate will then provide an initial assessment of your case and suggest possible strategies for resolution. This is also an opportunity for you to gauge the advocate’s expertise and communication style. You’ll learn about their approach to handling cases similar to yours and how they plan to tackle your specific issues.

Conclusion

Partnering with a tax advocate can significantly improve the way you manage your tax situation. Their deep knowledge and specialized skills can help you address complex tax issues, resolve disputes with the IRS, and make the most of tax-saving opportunities. By carefully selecting a qualified tax advocate and being well-prepared for your consultations, you can ensure that your tax matters are handled efficiently and effectively. With their guidance, you can confidently navigate the intricacies of tax laws and focus on other important aspects of your life or business. Whether dealing with audits, unfiled returns, or tax debt, a tax advocate's expertise is invaluable in securing favorable outcomes and providing peace of mind.

Contact Us:

Location - 7220 N Lindbergh Blvd Ste 120 Hazelwood, MO 63042

Email - [email protected]

Website - DTK Financial Group

Blog - Tax Advocate Tips: Making the Most of Your Tax Situation

0 notes

Text

All these stories - about kids being lost when a partner dies or not being able to visit people when their in the hospital because their parents think you're a hateful sinner - are the reason I get motherfucking LIVID when someone says that the solution to marriage equality is to just get government out of marriage entirely. And to leave it to the religious ballsacks who cause those problems.

Because some things like medical power of attorney or a good will can grant you some of the benefits of marriage. But not all of them. And none of those are as iron-clad and difficult to dispute as a marriage license.

Because a marriage license is a sort-of contract between you and your spouse that does something that regular contracts cannot. They impose requirements and actions on third parties.

There's no contract you and someone else can sign that says "We have decided that their health insurance company is now required to add me to their plan" or "We haven't consulted the IRS about this, but from now on we're going to be filing as a couple."

To impose those kinds of things on someone not a party to the marriage requires that the government backs and enforces those things. And you can't do that with a civil union.

And I really don't see why marriage can't include poly relationships and be open to more than just two people. The only reasons I've ever seen are the aforementioned religious fuckwads who are against anything they don't personally approve of and questions about "But what if one person in a triad wants to get divorced? How would you split the assets?"

And I guess that last one could be a problem. But it's not like the United States has a shortage of divorce lawyers who wouldn't gladly charge you a couple hundred an hour to solve it.

this might be because I’m a family law lawyer and also an old crone who remembers when marriage equality wasn’t a thing (as in, marriage equality only became nation-wide two months before I went to law school), but I have Strong Feelings about the right to marry and all the legal benefits that come with it

like I’m all for living in sin until someone says they don’t want to get married because it’s ~too permanent~ and in the same breath start talking about having kids or buying a house with their significant other. then I turn into a 90-year-old passive-aggressive church grandma who keeps pointedly asking when the wedding is. “yes, a divorce is very sad and stressful, but so is BEING HOMELESS BECAUSE YOU’RE NOT ENTITLED TO EQUITABLE DISTRIBUTION OF MARITAL PROPERTY, CAROLINE!”

64K notes

·

View notes

Text

How Tax Lawyer Help Resolve IRS Disputes and Audits

Introduction

IRS disputes and audits are challenging and stressful to navigate. The process is complicated, from the understanding of tax regulations to negotiating with authorities, where the stakes are high and the consequences of a misstep can be quite severe. Here is where tax lawyer come into play. They are experts in tax law and have experience handling intricate cases, thus becoming valuable allies for individuals and businesses facing IRS challenges.

What Is an IRS Audit?

An IRS audit is a check of an individual's or a business's records to ensure adherence to tax law. Audits can be motivated by discrepancies, inconsistencies, or red flags that appear in the tax returns of an individual or business. However, audits themselves are not punishment; errors and unresolved issues lead to penalties, fines, and even lawsuits.

How Tax Lawyers Assist in Resolving IRS Disputes and Audits

Expert Analysis of Your Tax Situation : Tax lawyers have the in-depth knowledge of tax laws and regulations. They can scan your financial records and tax filings to determine the reasons for the audit. Their expertise helps them anticipate what may concern the IRS and come up with a plan to handle them appropriately.

Representation during IRS Audits : Facing the IRS alone is a daunting experience. Tax attorneys serve as your representatives, writing on your behalf to the IRS. They will make sure all your documentation and response are correct, timely, and in compliance with the legal system.

Negotiating Settlements : If any differences are discovered, tax lawyers may negotiate with the IRS to favorably settle it. This might involve reducing the penalties, planning for a payment plan, or securing an offer in compromise in which the liability for taxes would be settled for less than what is owed.

Protecting Your Rights : Tax attorneys know the taxpayer's rights and see to it that the IRS observes them at all times during the audit process. They prevent overreaching, guard sensitive financial information, and make sure they receive fair treatment.

Resolving Tax Disputes : Other than audit tax lawyers represent in disputes that arise from mistaken assessments of tax, claims for refunds, and abatement of penalties. They may file an appeal, represent in tax court, and file litigation if need be.

Prevention of Future Problems : A good tax lawyer doesn't only solve the current issues but also assists clients in the implementation of better tax practices that will help them avoid future disputes. This may include tax planning, compliance, and record-keeping.

Benefits of Hiring a Tax Lawyer

Specialized knowledge: Tax attorneys have extensive experience with tax codes, IRS procedure, and other legal nuances.

Strategic approach: They tailor strategies based on your individual situation to obtain the best outcome.

Stress reduction: You're free to do what you like because the burden of dealing with the complexities lies with the attorney.

Risk reduction: Their experience reduces the possibility of further penalties or escalations.

Partnering with Professionals for Tax Compliance

For those people and businesses under IRS audit or dispute, the first step toward resolution is to hire a tax lawyer. GTS Consultant India has professional, experienced experts to provide solutions tailored to your needs in solving tax challenges. They have proven their track record in tax compliance and dispute resolution and can be trusted to guide through even the most complex cases.

Conclusion

IRS disputes and audits can be very overwhelming, but they don't have to be if the right support is there. Tax lawyers bring in invaluable expertise in acting as defenders and advisors for guiding you through the process. Whether it's representation during an audit, negotiating settlements, or ensuring future compliance, tax lawyers are the allies you need in safeguarding your financial well-being. For more information on professional tax compliance services, visit GTS Consultant India.

0 notes

Text

How to Navigate Payroll Tax Issues with Confidence

Introduction

Taxes can be a complex and stressful topic, especially for businesses handling payroll. Have you ever felt overwhelmed trying to comply with payroll tax laws or facing the possibility of an audit? You’re not alone. Many businesses encounter challenges with payroll tax issues, ranging from audits to garnishments. The good news is that there are experts ready to help, including the best payroll tax fraud lawyer and payroll tax attorney services available.

What is Payroll Tax Fraud?

Payroll tax fraud occurs when businesses intentionally misreport or fail to report payroll taxes to the IRS. This can include underreporting employee wages, misclassifying workers as independent contractors, or not remitting withheld taxes. It’s like trying to build a house on a shaky foundation — eventually, it’s bound to collapse. The consequences can include hefty fines, criminal charges, and even jail time.

Common Causes of Payroll Tax Issues

Payroll tax problems often arise from clerical errors, such as simple mistakes in calculations or record-keeping. Misclassification of workers is another common cause, where employees are treated as independent contractors to avoid payroll taxes. Cash flow problems, such as failing to remit taxes due to financial struggles, also contribute significantly. Addressing these issues proactively can prevent them from snowballing into bigger problems.

Signs You Need a Payroll Tax Fraud Lawyer

Not sure if you need legal help? Repeated IRS notices, facing a payroll tax audit, or legal actions like garnishment threats are clear indicators. A payroll tax fraud lawyer can provide the guidance and representation you need to navigate these challenges effectively.

Understanding Payroll Tax Audits

How a Payroll Tax Attorney Can Help

Hiring a payroll tax attorney can make all the difference. They represent you in communications with the IRS, negotiate settlements to reduce penalties or arrange payment plans, and provide expert advice on compliance and legal strategies. Their expertise ensures your interests are protected throughout the process.

The Role of an Attorney to Stop Garnishment

When the IRS starts garnishing your wages or bank accounts, it can feel like sinking in quicksand. An attorney to stop garnishment can file legal motions to halt garnishments, negotiate alternative resolutions with the IRS, and help you regain control of your finances. Their intervention can often provide immediate relief and a clear path forward.

Choosing the Best Tax Lawyers in New York

New York’s tax laws can be as complex as the city itself. Finding the best tax lawyers in New York involves evaluating their experience, reputation, and specialization. Look for professionals with years of handling payroll tax cases, positive client reviews, and proven expertise in payroll tax fraud and garnishments.

Tips to Avoid Payroll Tax Problems

Prevention is the best strategy when it comes to payroll taxes. By implementing sound practices, you can reduce the risk of issues.

Best Practices to Stay Compliant:

Use reliable payroll software to automate calculations.

Stay updated on tax laws and requirements.

Conduct regular internal audits of payroll records.

Consult a payroll tax attorney for proactive advice.

Benefits of Professional Tax Help

Why go it alone when you can have an expert by your side? Professional tax help offers peace of mind by ensuring your taxes are handled correctly. It saves you time, allowing you to focus on your business while experts handle the IRS. Moreover, it reduces risks by avoiding costly mistakes and penalties.

How to Handle Payroll Tax Audits with Confidence

When to Seek Legal Assistance

Don’t wait until it’s too late. Seek help if you receive audit notifications, struggle with payroll tax compliance, or face legal actions like garnishments. Early intervention can often prevent more severe consequences.

Conclusion

Navigating payroll tax issues doesn’t have to be a nightmare. Whether you’re dealing with an audit, garnishments, or compliance challenges, there’s help available. By working with the best payroll tax fraud lawyer or payroll tax attorney, you can protect your business and move forward with confidence. Remember, the key to success is proactive planning and seeking expert guidance when needed.

FAQs about Payroll Tax Issues

What happens if I’m found guilty of payroll tax fraud?

You could face fines, criminal charges, and even imprisonment.

How long does a payroll tax audit take?

It varies but can last several months depending on the complexity.

Can an attorney stop IRS garnishments immediately?

Yes, they can file motions to halt garnishments and negotiate alternative resolutions.

Are payroll tax issues common?

Yes, especially for small businesses juggling multiple responsibilities.

How do I choose the best payroll tax attorney?

Look for experience, positive reviews, and specialization in payroll tax cases.

0 notes